35+ Calculate Take Home Pay Massachusetts

Rates for 2022 are between 094 and 1437. 1 day agoAnnuity payout after taxes.

Best Personal Loans In Springfield Top Lenders Of 2023 Moneygeek Com

Employers pay Massachusetts unemployment tax on the first 15000 of an employees wages each year.

. For a Florida resident filing. If your total income will be. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Low income earners under a certain limit do not have to pay tax. A state personal exemption exists and varies based on. If your total income will be.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. March 19 2022. Take Home Pay Calculator.

Base rates range from 094 to 1437 depending on your. Enter an amount for dependentsThe old W4 used to ask for the number of dependents. That means that your net pay will be 43085 per year or 3590 per month.

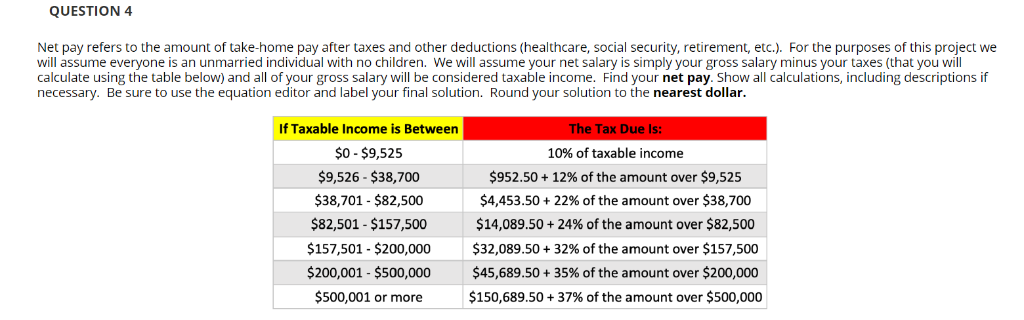

Heres how to calculate it. How much youre actually taxed depends on various factors such as your marital. It can also be used to help fill steps 3 and 4 of a W-4 form.

Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. Enter an amount for dependentsThe old W4 used to ask for the number of dependents. This free easy to use payroll calculator will calculate your take home pay.

For annual and hourly wages. The new W4 asks for a dollar amount. The state income tax rate in Massachusetts is a flat rate of 5.

The new W4 asks for a dollar amount. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. Supports hourly salary income and multiple.

The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. Rates are generally determined by legislation. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN.

If you make 55000 a year living in the region of Massachusetts USA you will be taxed 11915. Just enter the wages tax withholdings and other information. Limited Company outside IR35.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Your average tax rate is 1198 and your. Calculate your take home pay after federalstatelocal taxes deductions and exemptions.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The first 15000 of an employees earnings each year is taxable for unemployment insurance. Massachusetts Income Tax Calculator 2021.

Heres how to calculate it. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Take Home Pay Definition Example How To Calculate

The Suffield Observer September 2022 By The Suffield Observer Issuu

Here S How Much Money You Take Home From A 75 000 Salary

How Square Footage Is Calculated Sq Ft Calculation Explained

Massachusetts Paycheck Calculator Smartasset

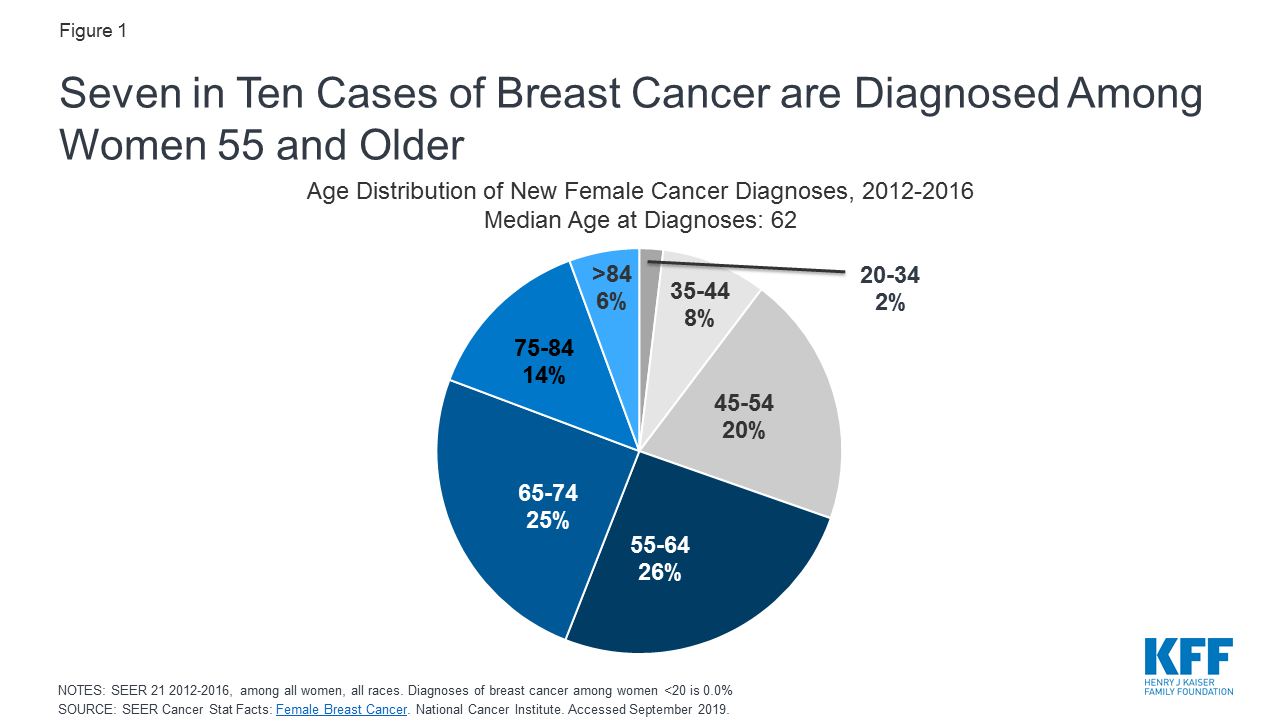

Coverage Of Breast Cancer Screening And Prevention Services Kff

Catc Ex991 24 Pptx Htm

New Tax Law Take Home Pay Calculator For 75 000 Salary

Social Security United States Wikipedia

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Traditions At Federal Way Apartments 31701 Pete Von Reichbauer Way S Federal Way Wa Rentcafe

Massachusetts Salary Paycheck Calculator Gusto

Massachusetts Salary Paycheck Calculator Gusto

Harborwalk Apartments At Plymouth Station Plymouth Ma Apartments For Rent

Jack Hurd Gibson Sotheby S International Realty Ma Real Estate

Older Drivers Emerald Insight

Massachusetts Salary Calculator 2023 Icalculator

Prime Realty Group