Mortgage calculator no pmi

FHA requires a monthly fee that is a lot like private mortgage insurance PMI. Using our mortgage rate calculator with PMI taxes and insurance.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance4-032e9dfa86f4428395ca45cbb2628baf.png)

How To Outsmart Private Mortgage Insurance

Then get pre-qualified to buy by a local lender.

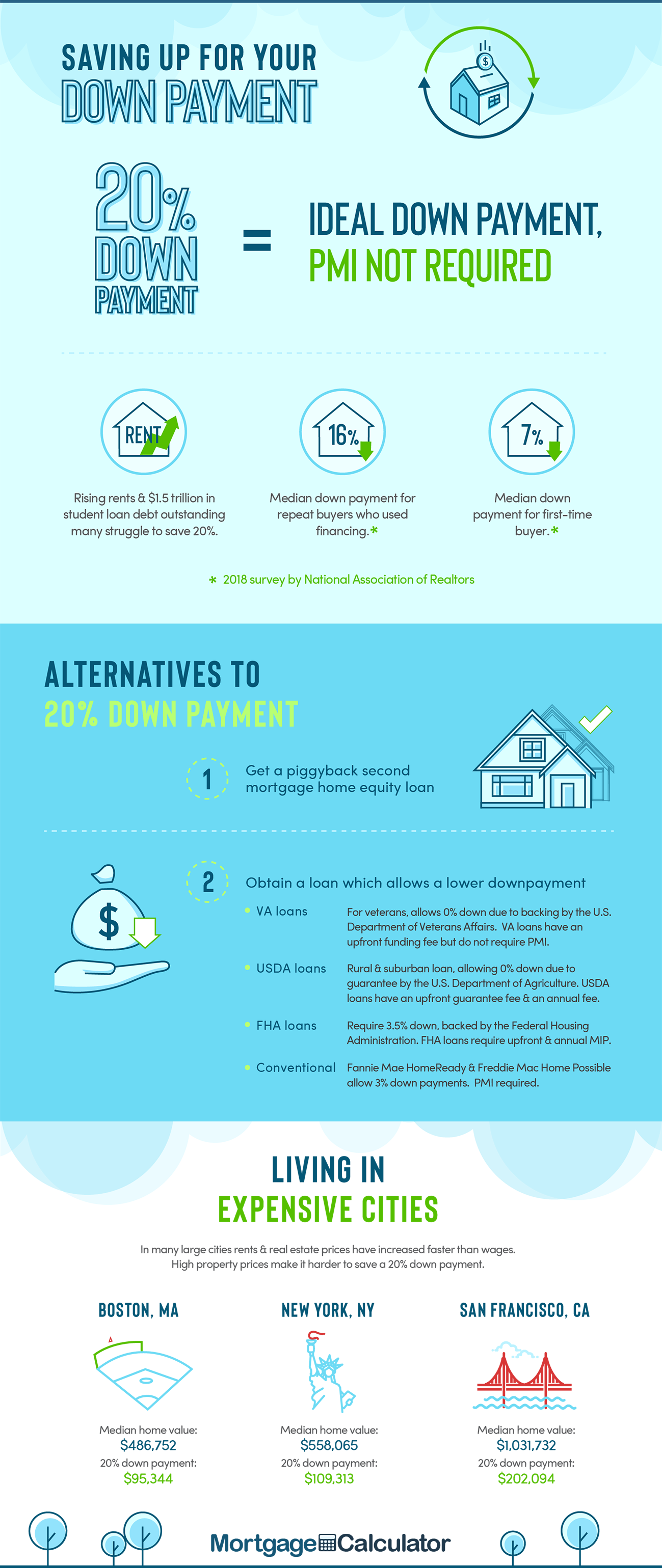

. Tips to Shave the Mortgage Balance. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

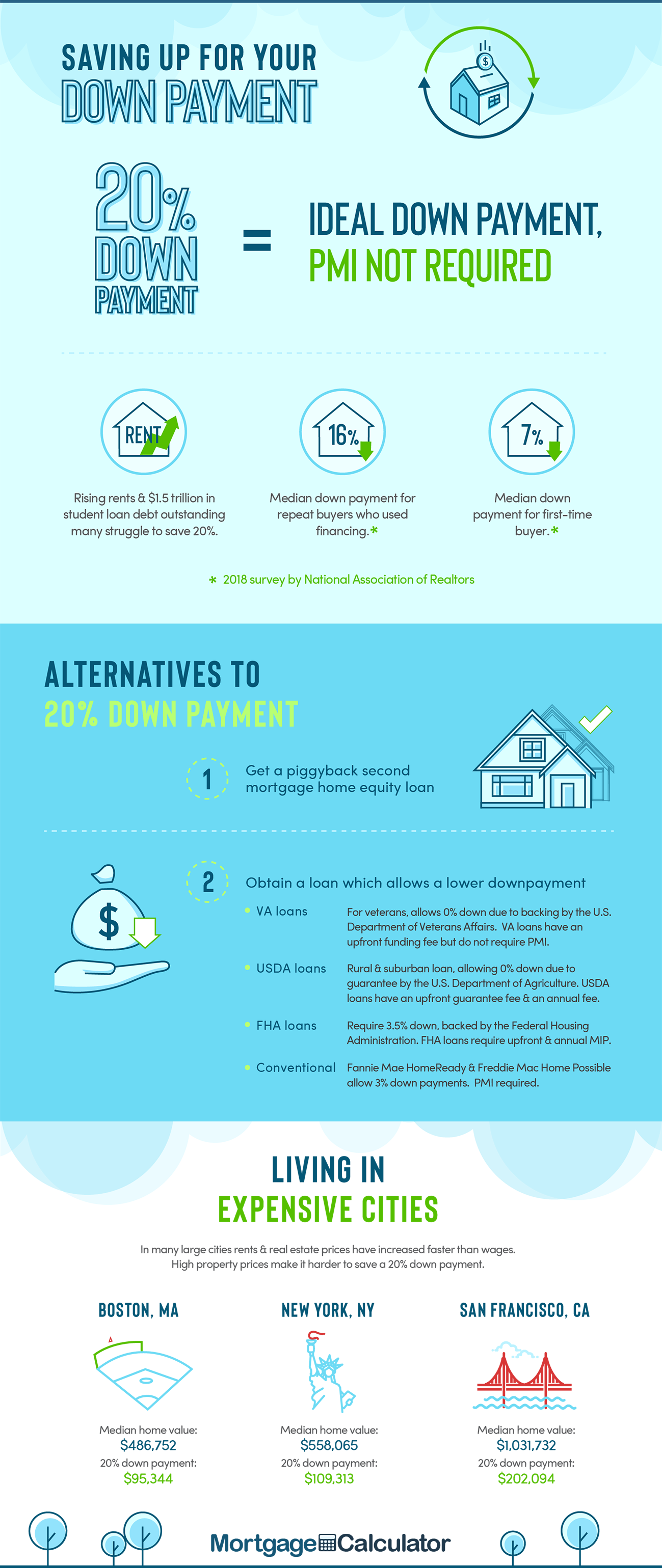

The calculator divides your annual property taxes by 12 to calculate this monthly amount. Down payment 5 down 15 down 20 down. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of.

PMI protects the lender in case you default on the loan. The mortgage amount rate type fixed or variable term amortization period and payment frequency. The fee is much lower than FHA mortgage insurance premiums MIP or even most conventional loan private mortgage insurance PMI rates.

If you have to pay private mortgage insurance PMI youre likely looking forward to the day your home equity hits 20 of the home purchase price so you can be released from PMI payments on. A mortgage in itself is not a debt it is the lenders security for a debt. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Across the United States 88 of home buyers finance their purchases with a mortgage. If you make less than a 20 down payment the estimated monthly PMI charge displays ehre. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

With a down payment of 20 or more. To avoid paying private mortgage insurance PMI on a conventional loan lenders expect a down payment of at least 20. FHA loan calculator including current FHA mortgage insurance rates taxes insurance HOA dues and more.

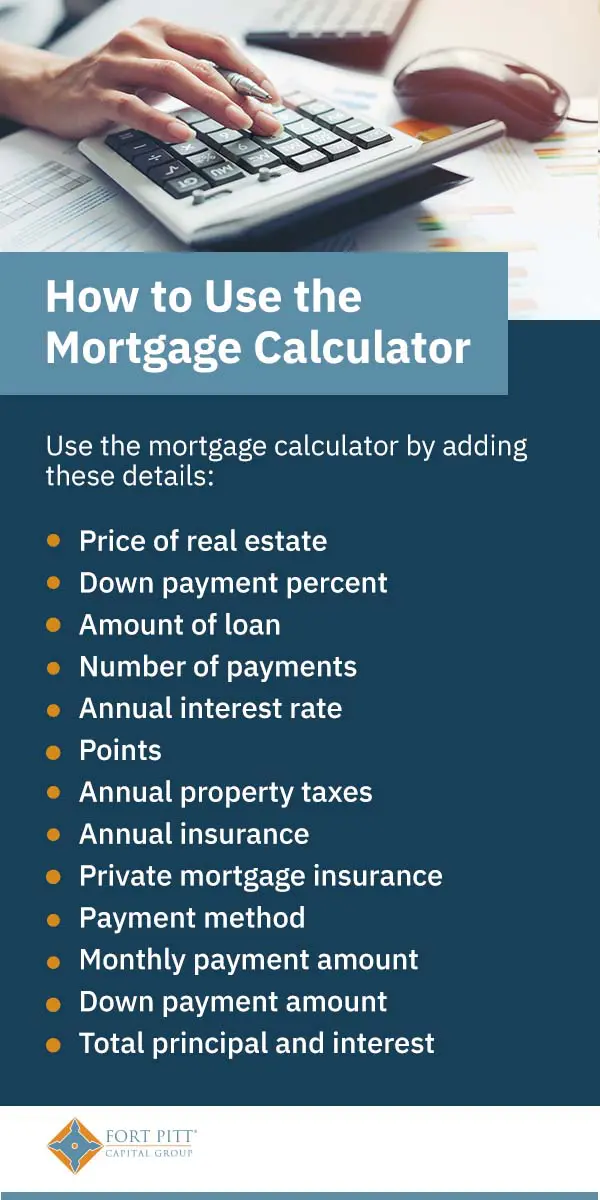

If your initial downpayment is below 20 you can request PMI be removed when the loan-to-value LTV gets to 80. PMI fees vary depending on the size of the down payment and the loan from around 03 percent to 115 percent of the original loan amount per year. The cost of PMI varies greatly depending on the provider and the cost of your home.

What do you do. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Lets take a moment to go through the various moving parts of the home loan calculator to get a better.

That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. The easiest way to determine the rate is to use a table on a lenders website.

Estimate your payment with our easy-to-use loan calculator. For most conventional loans youre required to pay for private mortgage insurance PMI along with your monthly mortgage payment until your loan-to-value LTV reaches 78-80. According to the Freddie Mac mortgage insurance calculator and the Bankrate mortgage calculator.

Private mortgage insurance PMI. Learn how to use our mortgage calculator to determine your monthly mortgage payments including PMI taxes insurance down payment interest rate and more. Use this free Illinois Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

With a help of Calculator a borrower can determinate the moment when paying for private mortgage insurance is no longer necessary due to the amount of money that was already paid. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

With a down payment of 20 or more. Avoid private mortgage insurance. The charge for PMI depends on a variety of factors including the size of your down payment but it can cost between 025 to 2 of the original loan principal per year.

Use this free Florida Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. That moment can be calculated with loan to value ratio that shows the exact date when the loans principal balance fall to 80 of the homes purchase price. Your homeowners insurance premium is divided by 12 to calculate this monthly amount.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Here is where you enter the additional costs that are typically billed as part of your monthly mortgage payment. The loan is secured on the borrowers property through a process.

See how changes affect your monthly payment. PMI on conventional mortgages is automatically canceled at 78 LTV. Fannie Mae HomePath mortgage.

If you pay less than 20 lenders will expect you to pay PMI as. The HOA fee is included here if applicable. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI.

Once the equity reaches 20 of the loan the lender does not require PMI. Property taxes homeowners insurance homeowners association fees or dues and private mortgage insurance PMI or FHA mortgage insurance if applicable. Use the worksheet indicated to enter estimates for those figures.

Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. Determine the mortgage insurance rate. Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage insurance.

Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. So if at all possible save up your 20 down payment to eliminate this.

It does nothing for you except put a hole in your pocket.

Downloadable Free Mortgage Calculator Tool

What Is Pmi Understanding Private Mortgage Insurance

Home Loan Downpayment Calculator

5 Alternative Ways To Use A Mortgage Calculator Zillow

Mortgage Calculator Estimate Your Monthly Payments

Top 10 Free Mortgage Calculator Widgets

/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

How To Outsmart Private Mortgage Insurance

Mortgage Calculator Money

Pmi Calculator Mortgage Insurance Calculator

5 Best Mortgage Calculators How Much House Can You Afford

What Is Pmi Understanding Private Mortgage Insurance

Which Is The Best Mortgage Calculator Zillow Bankrate Smartasset Calculators With Pmi Taxes Insurance Advisoryhq

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Calculator App

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Mortgage Calculator Tutorial Mc Mes Fm Youtube

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Free Mortgage Calculator Free Financial Tools Transunion